Bite the hand

After 15 years at Vanguard, I have a lot of swag. A nice briefcase that I’ve been carrying for years. A black Vanguard International jacket that I wear a lot. A lovely glass bowl. Lots of T-shirts. A healthy 401(k). You’d think I’d be a grateful retiree.

However. Vanguard is at the back of the pack in terms of how it casts proxy votes on climate issues. So I wrote a long letter which I e-mailed to two of its investor stewardship executives, one of whom I worked with many years ago. He e-mailed me back and said he’d like to learn more about Preventable Surprises. He also said he’d get back to me with Vanguard’s position on climate resolutions at upcoming annual general meetings at Exxon, Chevron, and three utilities. Here are the reasons I gave to convince Vanguard to cast “yes” votes on these resolutions:

•Vanguard cannot claim to be a long-term investor while ignoring climate change, whose “long-term” consequences are already visible, threatening agriculture, low-lying real estate, and public health.

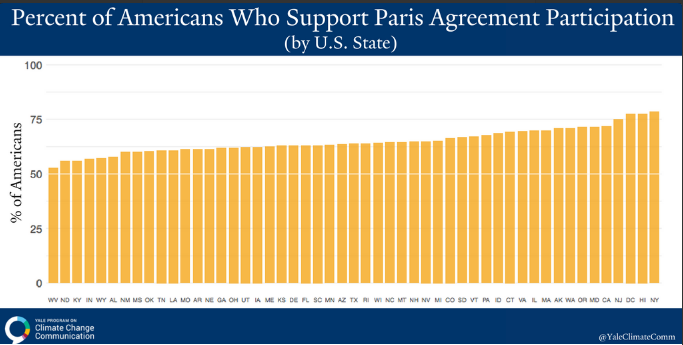

•Vanguard cannot claim to be shareholder-focused when the majority of shareholders support the Paris Agreement’s 2°C target.

•Vanguard cannot sell itself to its employees as a green company with a small carbon footprint if it is not concerned with the policies of carbon-intensive portfolio holdings.

•Proxy Voting Conflicts, a report by the 50/50 Climate Project, asserts that large investors vote with management at investee companies to protect annual management fees. Vanguard faces reputational damage if it is seen as ignoring the long-term interests of its end beneficiaries in order to curry favor with plan sponsors.

•Voting against 2°C resolutions undermines the work of the Task Force on Climate Related Financial Disclosure, which seeks to increase transparency around climate risk, allowing investors to make informed decisions.

•Vanguard has repeatedly ranked at the bottom of lists gauging investor support for ESG measures. In the UK and Europe, performance on socially responsible investment criteria is a common factor in mandates, potentially harming Vanguard’s growth.

5-11